Blockchain – A Chance for Alternative Investment Servicing

During the last year blockchain applications utilized by the financial industry have been picking up speed. From the announcement of a successfully tested pilot for catastrophe swaps by Allianz Risk Transfer in June last year, to the first functioning blockchain solution for a private equity fund announced by Northern Trust and IBM in February, and to the implementation of a distributed ledger (DL) technology for syndicated loan servicing by Synaps Loans and Credit Swiss in March this year: Several proof of concept have been provided demonstrating the usefulness of blockchain applications on illiquid alternatives.

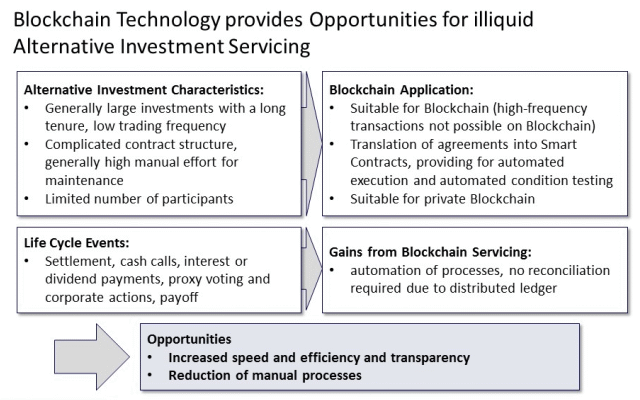

With their typical characteristics, illiquid alternatives seem to be the beneficiaries to profit from the utilization of blockchain technology. As current blockchains are not suitable for high-frequency transactions, however, they provide immense capabilities for the automation of large investments with a long tenure, low trading frequency, a complicated structure and a limited number of deal participants. All life cycle events from settlement, to cash calls and interest or dividend payments to proxy voting for corporate actions and final payoff come into scope for possible automation via blockchain applications – leading to increased speed and transparency and a reduction of manual processes.

The proven blockchain solution created by Northern Trust and IBM for a private equity fund has shown that increased speed and transparency and an accelerated time to market can be reached by applying DL technology. In this example, each counterparty participates with its own node, including investment managers, general partners, limited partners, fund administrators, auditors and the regulator. All of them have access to the shared distributed ledger.

Equally interesting is the syndicated loan servicing blockchain solution of Synaps Loans and Credit Swiss, which is shared by a variety of banks. Through implementation of a distributed ledger technology and smart contracts, the servicing of syndicated loan facilities is supported from origination to payoff and from creation to settlement in secondary trading. The solution provides increased transparency and efficiency and claims to be the most automated market solution today. It provides savings by reducing manual reviews, data re-entry and system reconciliation, and it benefits borrowers, agents and asset managers.

At Anadeo, we keep pace with the current developments in order to support asset managers in the analysis and implementation of possible Blockchain use cases – optimizing operations and enabling first movers.