Front to Back Office

Front to Back Office

Asset management is often reduced to investment decisions, portfolio management and trading of securities.

Anadeo understands asset management as a front-to-back requirement. This means from the analysis of the selection of the securities to be invested in, through the trading, settlement and administration of the securities, to the preparation of the annual financial statements and the associated reports, and thus all process steps that an asset manager goes through in the day-to-day business.

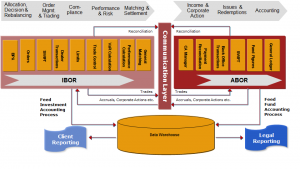

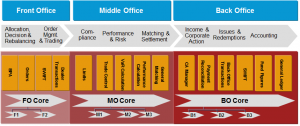

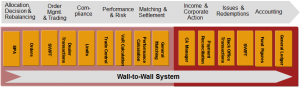

As part of numerous implementation and optimization projects, Anadeo supports its customers along all processes front to back in planning and implementation in order to implement their strategic and tactical decisions operationally. Accordingly, a project in asset management for Anadeo includes the implementation of the requirements across the entire operational process chain, no matter which operational or technical approach the customer has or chooses as basis. Whether it is an IBOR / ABOR architecture (investment book of records and accounting book of records), a best-of-breed solution or a wall-to-wall solution as technical support for the operational process of investment decisions, processing and accounting.

It is part of the Anadeo approach that the interaction with market participants and partners of the respective asset manager (custodian bank, advisory partner, outsourcing partner for certain functions along the value chain) and corresponding interfaces in each of the individual areas is taken into account during implementation and optimization.

Anadeo is able to support its customers front to back, particularly when implementing new professional and technical processes

For more than 20 years, Anadeo has been advising customers on the design, implementation and technical implementation of new processes across the entire asset management value chain.

Anadeo Consulting Services Along the Value Chain

Asset Management

Asset management companies aim to create and maintain financial security and prosperity for their customers. The focus is set on their financial goals and needs, and appropriate investment strategies are developed and implemented.

This includes:

- Investment advice: selection of asset classes, investment strategies and objectives.

- Portfolio Management: Managing a portfolio taking into account the client’s individual needs and risk tolerances.

- Diversification: Investing in different asset classes to minimize risks.

- Risk management: monitoring and controlling investment risks.

- Customer Care: Interacting with customers to understand and address their needs.

Custodian Bank

Depositories are an essential part of the global financial system and contribute to the security, integrity and efficiency of financial markets. In particular, the role of custodian banks in Germany, Austria and Switzerland provides a reliable and secure custody solution for securities and enable investors to manage and trade their assets effectively. Institutional investors such as “Spezialfonds”, pension funds and insurance companies rely on custodian banks to meet the complex requirements associated with their assets as well as with the regulatory requirements.

- Custody of securities: The custodian bank stores the securities on behalf of its customers in their custody accounts. In the case of funds, those of the corresponding special fund in the name of the special fund.

- Processing trade orders: Custodian banks are responsible for the transfer of securities when processing transactions.

- Security and Protection: The primary responsibility of a custodian is to ensure the security and protection of the assets in custody. This includes protection against theft, loss or damage.

- Position keeping and reporting: Custodian banks keep records of their customers’ assets and provide regular reports and statements.

- Income distribution: Custodian banks handle the processing of interest income, dividends and other payments to investors.

- Exercising voting rights: In some cases, custodian banks exercise voting rights on behalf of their customers

- Corporate Actions: custodian banks execute corporate actions transactions, such as capital increases, stock splits or mergers.

Capital management company

Capital management company (Kapitalverwaltungsgesellschaft – KVG) is a term used particularly in German-speaking countries for companies that trade and manage securities investments for their customers in the form of a fund (special fund) and issue corresponding share certificates for them (fund companies). The core functions of a KVG are:

- Fund management: The management of investment funds includes the creation of funds, the creation and management of investment portfolios on behalf of the funds as well as the issuance of share certificates via the custodian bank, which can be purchased by investors.

- Investment strategy: the KVG develops investment strategies that are based on the fund’s objectives and market requirements. These strategies determine how the fund’s resources are invested in various assets.

- Regulation and compliance: KVGs are subject to strict legal requirements and regulations to protect the interests of investors and ensure the transparency and integrity of fund management.

- Reporting and communication: The KVG provides investors with regular reports on the fund’s performance and communicates with investors about developments and changes in the fund.